This post is an update on the same topic published at 30 October and has been updated by this post at December

This post is an update on the same topic published at 30 October and has been updated by this post at December

On 12 and 18 November 2008, i visited 5 banks to inquire their TIme Deposit Product, this post will elaborate the product and my experience with the bank. Other banks included in the previous post will also be included in a summarized format.

This post also includes the best place to put your money (based on my findings) for different level of fund.

Before we go further, the usual qualifiers and disclaimer. Any brands or registered trademark mentioned in this article are the property of their respective owner. The rate mentioned in this article are true to best of my knowledge as was informed by the person claiming to be the Customer Service Representative of respective bank at my visit, I am not responsible if the rates are proven wrong due to misquote on the party of the Customer Service, or the person providing the quote are not in charge on enforcing them, or any other miscommunication, Invest at your own risk. I am not paid by the banks listed in this article, and I especially are not paid by the winner, i do the research for my own personal need and simply share the result in this blog. I also skewed my research toward medium and small banks, since they usually give better return compared to more established banks. The survey was done on 12 and 18 November 2008 in the branches of banks in various location, thus, the interest rates being applied might vary at a different time and perhaps even different location.

The ranking is still determined based on the interest rate being offer at the minimal amount of money invested at the shortest amount of lock-in time. Asides from bank specific terms, opening a time deposit at almost all bank will involve a IDR 6,000 stamp cost.

The best place for funds

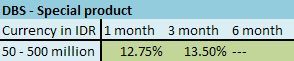

DBS Time Deposit is still the best product if your placement is below 50 million. Above 50 million, you’re better off with their special time deposit, if you go the branch, ask for any special product that they have.

Above 500 million, Mega Depo Premium offers an attractive rate. This Product offers an free Personal Accident insurance (But do notice the phrase Personal Accident, it doesn’t cover illness or disability, so for me, the insurance is more of a sweetener)

Above 1 Bn, Bank Capital publish a rate of 13.5% for the traditional time deposit, or you can still opt for the Mega Depo Premium. But at this level of fund, Rates are almost always negotiable, i suggest you shop around from the banks in the top level of the ranking.

On a side note, Citibank offers a Smart Bundle product that offers Deposit interest rates 14% and beyond, but because the product requires you to invest a matching amount in investment acount, and the investment account’s return is unpredictable, this will make the effective rate of holding the Smart Bundle product to be at 7% + half of the return of investment account. If the investment component tanked, you could be left with an effective return of 7% or less, if the investment perform below 13%, the product is still on par with Bank Mega’s Depo Premium, if the investment perform above 13%, only then the Smart Bundle becomes more competitive. Due to the uncertainty of the effective return, the Smart Bundle product is not included in the BEST category.

The Rankings

1. Still the Winner – DBS

Need to open a savings account. Admin fee is zero when Total Relationship Balance is above 10 Million.

2. Bank Victoria – Rank unchanged

No Savings Account is required

No Savings Account is required

3. Bank Capital (New to the ranking)

I visit this Bank on 12 November 2008, i visit their branch in the Roxy area of Jakarta.

I visit this Bank on 12 November 2008, i visit their branch in the Roxy area of Jakarta.

When i first saw the bank, i fought “What bank is this, its most probably be new and small, might provide good rates”. Now, some risk warning, the Bank state that it is covered in the Government Deposit Guarantee program, but to be fair, it’s size brings with it some additional risk compared to more established banks. As a small bank, it needs to be aggressive, but tragically, its aggressiveness also bring added concern, since the bank cost of fund also increases. Please note that such risk exist in any small bank, not just Bank Capital.

But before you ditch this bank out, keep in mind that small size usually means better customer service, since the bank has an incentive to attract and maintain customers.

Why is this bank’s ranking higher than Panin? because Bank Capital provides a better rate for funds 100 million and above.

No savings account with Bank Capital is required. Upon due date, the deposit can be transferred or carried in cash, incurring associated transfer or stamp cost.

Note, the bank is quite aggressive in looking for funds, the Head of the Roxy Branch called me twice in less than one week to further inquire my interest. If you are willing to stomach some risk (since interest beyond 10% is not covered by the government guarantee program) and get higher return, you might want to try to negotiate a rate with Bank Capital.

4. Bank Panin

No savings account is required

5. Bank Century

No need to open a savings account.

6. Bank Artha Graha

Might need to open a savings account.

Might need to open a savings account.

7. Bank Ekonomi

No need to open a savings account.

8. Citibank (New to the ranking)

I visited the Bank’s branch in Kebon Jeruk area on 18 November 2008.

I visited the bank because i receive a text message promoting a 13% rate product with Citibank.

I had a horrible horrible experience with Citibank when i was in Germany, I’m not so eager to approach this bank as a customer, but looking at the 13% rate, and the possibility that Citibank Indonesia might have a better attitude than their colleagues in Germany, i decided to visit this bank.

Upon arriving at the bank, i talk to the information desk to inquiry on Time deposit product. Learning that i don’t have a citibank account, the person at the info desk whips a paper filled details on their savings account, and start to talk on the savings accounts procedure, impressively efficient, but annoying. I cut him off, and restate my interest in their time deposit. “Oh, we have several of those sir” and points to a A4 size stand with the listed rates for the various product. But rather than give me a copy of the paper, and save time for everybody, he asked me to wait while he fetch a Personal Banker. In all fairness, the Personal Banker prove to be useful.

The personal banker inquiry what the amount of money i want to deposit, i give her a fair number, and she outlines 3 type of products.

She first mention the Ladder Deposit

The ladder deposit has a long tenure, 12 months of locking period. The main feature is that you can withdraw the fund before the 12 months period, but the drawback is that you will suffer a lower interest rate being applied to the deposit if you decide to withdraw before the 12 months is up.

If you withdraw in 3 months, the applied rate is 7.2%; withdraw in 6 months, the rate is 8.4%; withdraw between 6 and 12 months, the rate is 9.6%.

The same interest rate is applied to any size of fund.

The second product is the Super Save, which is their version of a traditional time deposit

You might notice that the interest rate is quite high, but i positioned their product this low in the ranking because….the high amount of minimal fund that you need to place. Super Save requires a minimum of IDR 100 million, and at 9.25% it’s actually less attractive then Niaga’s rate for the same deposit size.

the third product is Flexible Deposit (i feel like i’m peddling their product…)

The flexible deposit allows the customer to withdraw any amount from the entire deposit before the maturity date. The drawback is that the amount that was withdrawn before the maturity date will receive a 6% rate, instead of the full published rate (which starts at 11%). Example: Let say you place IDR 500 million with Citibank Flexible Deposit, you commited the funds for a 6 month locking period. But at 3rd month you withdraw IDR 100 million, at this time, the IDR 100 million interest rate is 6%, the remaining IDR 400 million receives 11.25% rate. Then, in month 4, you withdraw another IDR 100 million, this IDR 100 Million receives 6% rate, while the remaining IDR 300 million, receives 11.25% rate.

At least, that’s my understanding of how the exact mechanism work. If any of the reader work with Citibank and is familiar with the product, feel free to post the official version in the comment box below.

A bit of personal observation. In 2 out of 3 products, the customer will only receive the full interest rate if they do not withdraw their funds. You could say that Citibank is offering its customer the chance to withdraw part of their deposit without losing the benefit of interest, which is quite nice. I tend to think that Citibank might saw a trend in how customer maintain their deposit, and capitalize on this trend by showing a high interest rate on their product list. This allow their product to stand out on brief observation by customers while keeping the actual cost of fund low should the observe trend, customers backing out from commitments, be realized. A clever move by Citibank, it’s up to you customers to keep your commitment should you decide to use their product.

I then ask the personal banker on this 13% product which offer i receive.

She then explains to me about the Smart Bundle product

The smart bundle is a smart product, smart for Citibank that is. Rather than bundling an investment product with an insurance (which is all to common with many banks selling bancassurance), Citibank bundles their investment product with a traditional banking product, the safest one at that, the time deposit.

In Smart Bundle, the customer must provide equal amount of fund to an time deposit component and an investment component. The Time Deposit component will receive 14% interest rate, while the investment component will receive unknown rate of return, depending of the performance of the selected investment instrument. Example, If i want to place a IDR 100 million deposit with Smart Bundle, then i also need to provide another IDR 100 million to purchase an investment instrument (most probably mutual fund). Off course i can choose which investment instrument i wish to buy.

But since both the deposit and investment component must be provided in equal amount, the return on the entire fund you provide (combining the deposit and investment) will equal to 7% + half of the investment return. 7% comes from 14% divided by 2 (since the deposit is exactly half of the entire fund), and half of the investment return also because the investment component comprise exactly half of the entire fund.

The upside: a 14% rate for the deposit component of the product.

The downside: 1. The rate of return for the entire fund you provide is unknown, subject to market performance. 2. Participating in the investment includes a purchase fee of 2% from the total investment. I personally hate fees that are defined as a percentage of asset, it encourage funds to sell and sell and sell their product, rather than to give maximum return for customers. If the performance tanked, the fund managers already enjoy the fee and only face the risk of not having new customers, while the customers gets burned.

Personally i prefer to have separate time deposit and investment account. Doing this allows me to understand the real cost and real return of each product, understanding the real cost and return then allows me to comparison shop effectively, and find the real bargain for each class of product. I find bundling tend to obscure such information for the customer.

But if you are interested in opening a time deposit and a investment account, you are looking for the highest return for your deposit, and are willing to take whatever return the market will give for the investment account, then the smart bundle might be a good option.

To participate in any of the products above, you must open a savings account with Citibank, the admin fee is zero if the Total Relationship Balance is above IDR 50 million

MOST DANGEROUS MOTORCYCLE PARKING AREA FOUND IN CITIBANK BRANCH

On a side note on the Kebon Jeruk branch. The branch has one of the MOST DANGEROUS motorcycle parking space i’ve ever seen, dangerous as in fatality waiting to happen. Parking space for cars is relatively ok, but the parking space for motorcycle is utterly dangerous. Whoever designed, construct, approve, and allow the motorcycle parking space to exist obviously never ride a motorcycle.

I protest Citibank for having such a dangerous motorcycle parking space. How can you allow your employee and potential customers to park their motorcycle in such a dangerous manner and space? This reflects poorly on their management attitude toward employee and customers, it’s like saying “if you don’t look like someone with money, then we don’t need to take good care of you”, unacceptable attitude in a service industry.

The management of Citibank cannot say that such dangerous parking space is accidental, a constraint that comes with the selection of their building. Citibank is responsible to find a building which facilities are AT LEAST SAFE for the users of the building, if the building’s facilities is not safe, then it is Citibank’s responsibilities to find a SAFE building. Deciding to stay in a building with unsafe facilities reflects either ignorance to the safety of others or management ineptitude.

9. Bank Niaga

Must open a savings account with Bank Niaga, called the Niaga X-tra. the admin cost is IDR 7,000/month and it cannot be waive at any level of savings. This requirement and its associated cost and the IDR 50 million minimum, places Bank Niaga at this position in the ranking.

Please note that the author has not revisit any Niaga product after the change to CIMB Niaga. The rates above are for Bank Niaga, not CIMB Niaga.

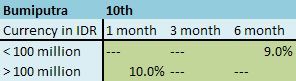

10. Bank Bumiputra

No need to open a savings account.

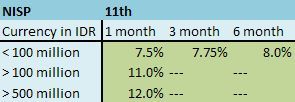

11. Bank NISP

No need to open a savings account.

No need to open a savings account.

12. Bank Mayapada

No need to open a savings account

13. Bank Mega (new to the ranking)

I visited Bank Mega branch in Tanjung Duren, West Jakarta on 18 November 2008.

At 7%, the bank’s time deposit doesn’t look very competitive, for the time deposit, you don’t need to open a savings account.

I’m quite impressed with the customer service representative, she quickly understands that i am shopping for the best rates and after sharing the above rates, she promptly deliver news of the Mega Depo Premium product.

This product offers a highly competitive rate, with a bit of sweetener added to the mix (the personal accident protection. In which case if the deposit holder deceased by cause of an accident, not illness, a designated party will be provided with the entire amount of deposit and a matching amount of insurance benefit)

The first downside of this product is its high entry limit, a minimal deposit of IDR 500 million, with subsequent saving to be provided in IDR 50 million increments.

Another downside is that you might need to open a savings account with Bank Mega to access this product. The admin fee of the savings account is IDR 7,000/month.

But at 14%, the rate is very competitive

14. Bank Mayora (new to the ranking)

I visited Bank Mayora main office in Tomang area on 18 November 2008

I visited this bank because, not long ago, i thought i saw a 10% rate for time deposit at that time.

Yet in my recent visit, I was perplexed to see their current interest rate, which, for a small bank, is not very competitive.

No need to open a savings account with Mayora

15. Bank BTN (new to the ranking)

Visited BTN branch in Roxy area on 12 November 2008.

I just visited Bank Capital when i saw this bank, i thought why not try to see what they offer, perhaps they can give me a pleasant surprise,

no such thing was found.

To be fair, the bank is quite big, so to see it this high in the ranking is actually a surprised, i initially thought BTN’s rate will sit below Permata.

No need to open a savings account

16. Bank Permata

You need to open a savings account with Permata.

You need to open a savings account with Permata.

17. Bank Lippo

As of 18 November 2008, the writer still decides to list Lippo Bank as a separate entity to Bank Niaga. The writer will consider to combine the listing when the Lippo branches has been rebranded to CIMB Niaga

You need to open a saving account, admin fee is IDR 10,000/month

—

Filed under: Personal Finance | Tagged: bunga deposito, bunga deposito bank, bunga deposito di Indonesia, Indonesian interest rate, Personal Finance, suku bunga |

Sen, 18 November ? Ente kaga gawe di BCG lagi yah bisa2 keliling2 jkt buat survey2 bank? Anyway gw pas hari senen kemaren juga survey beberapa bank di tanjung duren deket rumah gue yg bisa dicapai jalan kaki max 10 mnt (Mandiri, NISP, Mega, Danamon, Panin, Index, Ekonomi, BCA, Lippo, BRI), tapi produk tabungan, bukan time deposit.

Just want to know the best offer, pros and cons. At current the most attractive interest come from Bank Ekonomi, offered 4% p.a. Its ATM networks are ALTO & (..lupa ada di rumah). I’ll conduct further survey on other place nearby, on 24th Nov. Keep in touch and keep my mail : ryan.stephanus@gmail.com

Correction : Bank Ekonomi Interest is 4.75% p.a

ATM can be used in BCA ATM or any ATM within ALTO network

one downside is minimal deposit is 1 million IDR, even after cash withdrawal

but still appealing isn’t it ?

Thank you so so much for this post.

I had almost given up trying to find a proper time deposit investment in indonesia due to the ultra efficient customer service,which practically forces me to sit for a session of consultation(20-40 minutes) after which the customer service rep practically offers to scurry down the road to my office and fetch my non existent suit case loaded with millions of rupiah.

Your article is straight to the point and informative.

I too had taken note of bank victoria’s sudden generosity,was just a bit skeptical due to it being a private bank.your opinion on this?

Secondly,in ur opinion,which is the bank offering the best interest rates(minus service charge/tax)on a normal savings account?

Regarding DBS bank,what is the minimum prerequisite amount to be placed in savings in order to open a time deposit account?

And what is the admin fee like?

Lastly,kudos,great post!

for DBS, the minimum amount is IDR 10 million. With this amount, you don’t need to pay admin fee.

You need to pay several stamps when you open an account with them. I think total it’s around IDR 18,000 for the stamps.

[…] Suku Bunga Deposito Bank Di Indonesia – update December 2008 Posted on December 25, 2008 by sendy82 This post is an update on the same topic published at 30 October and 18 November. […]

wonder if my POSB saving account can use for open deposit account in DBS later…thanks for the information..

how about the profit..is there any deductions?

There’s definately a great deal to know about

this topic. I love all of the points you’ve made.